36+ tax deductions on mortgage interest

Married filing jointly or qualifying widow. You can deduct the interest on your mortgage on up to 1.

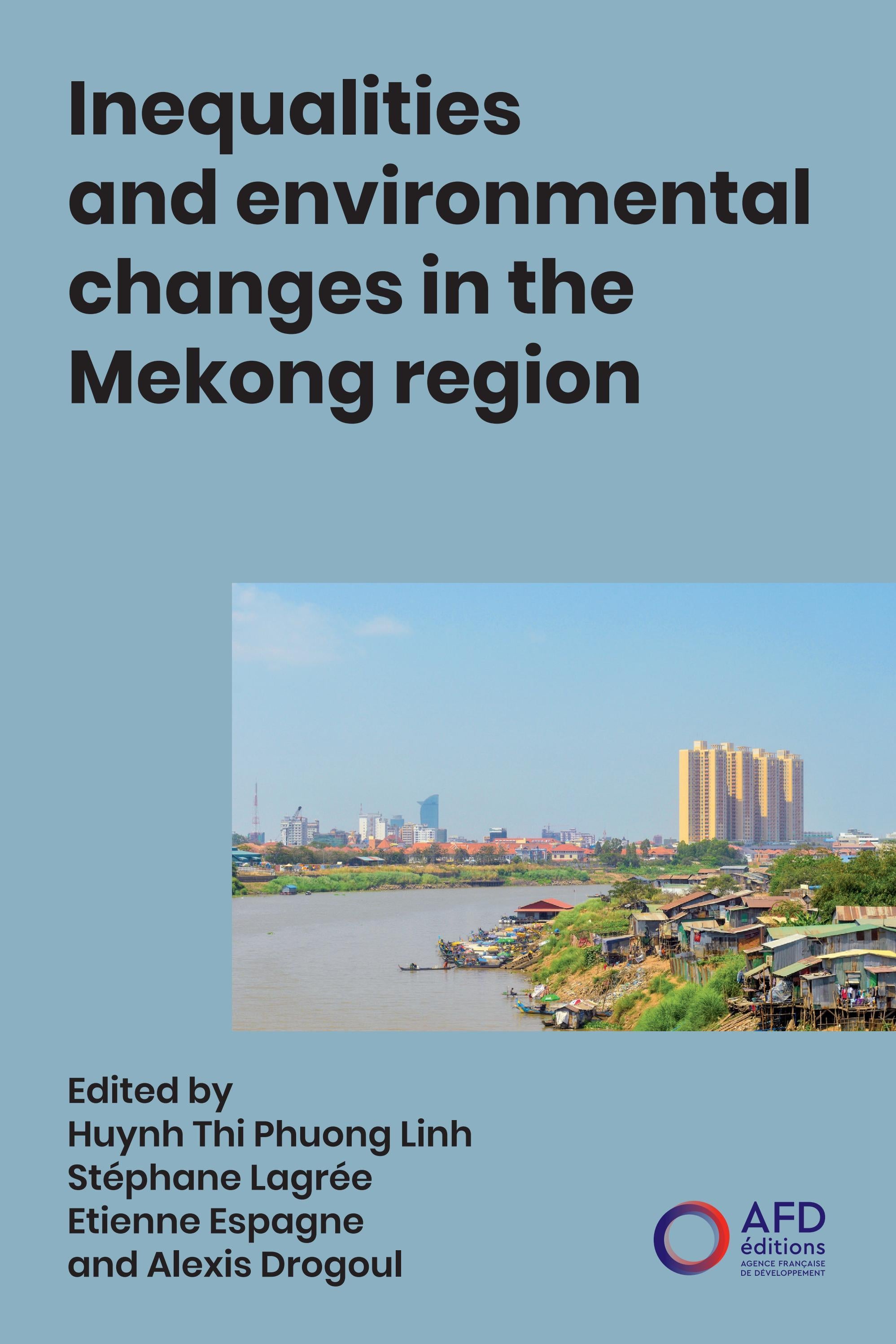

Inequalities And Environmental Changes In The Mekong Region By Agence Francaise De Developpement Issuu

Ad Dont Leave Money On The Table with HR Block.

. As each half amounts to. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Web For 2021 tax returns the government has raised the standard deduction to.

Web Mortgage Interest Deduction Qualified mortgage interest includes interest and points you pay on a loan secured by your main home or a second home. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Web One of the major downsides of being self-employed is that you have to pay both the employer and employee portions of Social Security tax. Taxes Can Be Complex. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Learn More at AARP. US politicians presented the First-Time Homebuyer Act of 2021 on April. Web Is mortgage interest tax deductible.

If you do qualify for having a home office that is eligible for some tax deductions the money saved will vary depending on the size. Well outline the basics here. Web The 1098 has multiple names and multiple people are paying the mortgageinterest.

Web Tax deductions lower your taxable income while tax credits could increase your refund or reduce the amount of taxes you owe. Single or married filing separately 12550. 16 2017 then its tax-deductible on mortgages.

Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on. Each can deduct their portion of interest paid.

Web For example if you pay 3000 in points to obtain a lower interest rate on your mortgage you can increase your mortgage interest deduction by 3000 in the. Web For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately regardless of. Get Your Max Refund Guaranteed.

Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as much. Web The IRS has lots of rules and guidelines to claiming the mortgage interest tax deduction. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Web Most homeowners can deduct all of their mortgage interest. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. Web Under the Tax Cuts and Jobs Act TCJA the interest is deductible on acquisition debt up to a 750000 threshold for 2018 through 2025 down from 1 million.

Our Tax Pros Have an Average Of 10 Years Experience. Web The tax credit is equivalent to 10 of the purchase price of your home and cannot exceed 15000 in 2021. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and indirect curbs.

Web Answer a few questions to get started. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. However higher limitations 1 million 500000 if married.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web 5 hours agoHow much can you deduct in 2023.

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

Mortgage Interest Deduction Rules Limits For 2023

Race And Housing Series Mortgage Interest Deduction

Mortage Interest Deduction What Is The Mortgage Interest Deduction

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction How It Calculate Tax Savings

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Presentation Htm

Home Mortgage Loan Interest Payments Points Deduction

Eu Council Manual Law Enforcement Information Exchange 7779 15

Mortgage Interest Deduction Bankrate

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Proptech Study By Proptech Switzerland Issuu